How much would your home sell for if you were to list it today? Has your home value gone up since you initially purchased your home? How much equity have you built up? Is your home’s value higher, now that the home down the street just sold for X?

If you’re like most homeowners, these questions (and many more about home value) pop up in your mind periodically as you determine whether to stay in your home for a while longer, move to a new home, refinance, or take out a home equity line of credit (HELOC).

In this article, we’ll share a behind-the-scenes look at some of the key factors we use in determining the value of your home if you were to list it for sale today – factors that will give you a much more accurate valuation than a quick Zestimate (i.e., an automated home valuation on Zillow or a similar website).

How Much Is Your Home Worth?

The simple truth is that your home is worth what a buyer is willing to pay. An estimate of your home’s value is a prediction of what most buyers would be willing to pay at a given time. This prediction requires a close look at two factors: recent home sales in your area, and an assessment of the real estate market.

Pricing your home correctly is fundamental to a successful outcome in the sale of your home, especially in extremely competitive markets like Oakland and the East Bay. Further, because home value estimates on sites like Zillow and Redfin are based on averages and algorithms, they can often miss the finer nuances of markets like the Bay Area.

Looking At Comparable Sales

The best way to create an accurate estimate of your home value is with a thorough market analysis. Recent closed sales in your area offer the most relevant data for predicting your home’s value.

If a 2,000 square-foot 3-bedroom / 2-bathroom home on the block next to yours just sold for $1.1 million last month, and your home is a similar size and has the same bedroom and bathroom count, that’s a good indicator of what today’s buyers would be willing to pay for a home similar to yours.

However, as you can probably guess, finding an exact comp (comparable sale) isn’t always possible, which is why it’s important to know what criteria to look for so you can include the most relevant comps and thus create the most accurate estimate of your home’s current value.

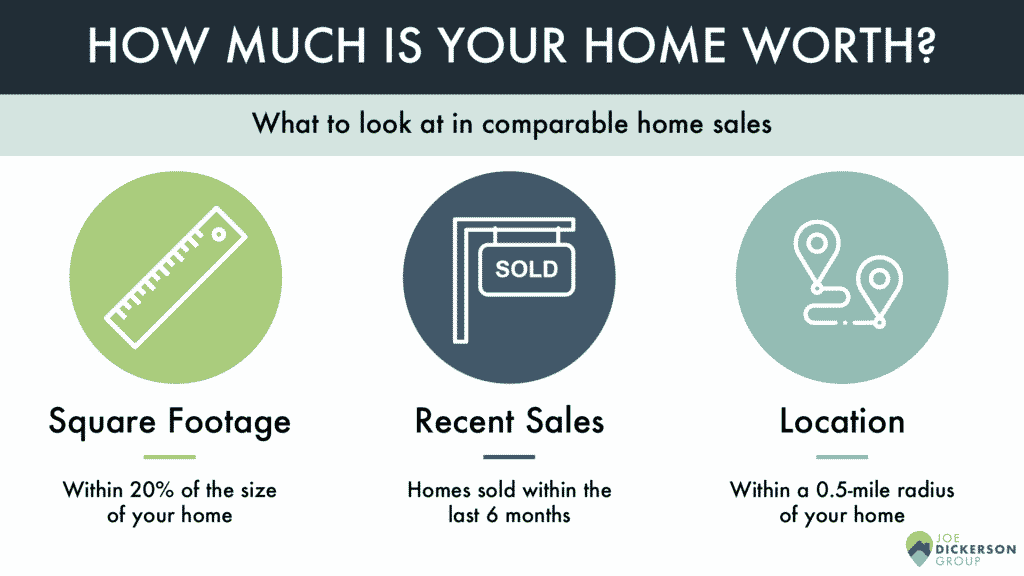

When looking at recent sales to determine home value, we recommend prioritizing 3 criteria as a starting point:

- Square footage of the home

- Time of sale

- Location

Square Footage Of Comparable Homes

We typically recommend starting by looking at homes whose square footage is within 20% of the size of your home.

For example, if your home is 1,000 square feet, you’d want to look at homes between 800 and 1,200 square feet to start. Looking at homes around the same size as yours is one of the best tools in helping you determine your home value.

Time Of Sale

The timing of the sales is another factor that plays into home value. We recommend looking at homes that have sold within the last 6 months, to ensure that those sales are still relevant in this ever-changing market.

Location / Submarket

And of course, because real estate is hyperlocal, particularly here in the Bay Area, we recommend looking at homes within your immediate area as the best indicator of your home value.

Starting with a smaller radius, then expand out as needed. We recommend starting by looking at homes within a 0.5-mile radius of your home.

Combining All Three Factors To Determine Your Home’s Value

Ideally, you’ll want to get a list of three to six good comparable sales to get an accurate estimate of your home’s value – homes that are within 20% of the square footage of your home, homes that have sold within the last 6 months, and homes within a 0.5-mile radius of your home.

If this search produces way more than six results, you may want to rein in the radius and square footage range and/or reduce the timespan to just the last one to three months.

If, on the other hand, the search produces very few or no results, try tweaking the search variables to see what comes up. Try expanding outward to a 0.75-mile radius, opening up the square footage to a greater range, or looking further back beyond 6 months ago.

Dig Into The Nuances Of Comparable Sales

Once you have a good list, dig into the specifics and nuances of each comparable home in order to increase the accuracy of your home value estimate. What are the factors that are the same as your home, and what are some factors that are different? Considering those nuances will help you get the most accurate home value.

Here are some nuances to consider:

- Location on the block – corner versus middle of the block

- Street noise

- Whether there’s a view

- Condition of the home

- Age of the home

- Size of the lot

- Outdoor space

- Layout of the home

- Desirability of the upgrades / style of the home / paint colors

- Whether there’s a pool

- Solar

- Air conditioning

- Parking – garage / off-street / tandem driveway

- Condition of neighboring homes

- Landscaping

- Whether there are fruit trees in the yard

- Proximity to commercial space (retail stores, gas stations, etc.)

If your home is superior or inferior to most homes in the neighborhood, or if there are no nearby sales, then it will be more difficult to anticipate the responses of potential buyers. This is where the art of determining home value comes into play and also where Zillow and similar sites fall short.

Keep in mind also that when your home is appraised for the buyer’s loan, the appraiser will only consider closed sales. List prices of homes on the market are of interest too, because they show the current pricing trend.

The State Of The Real Estate Market

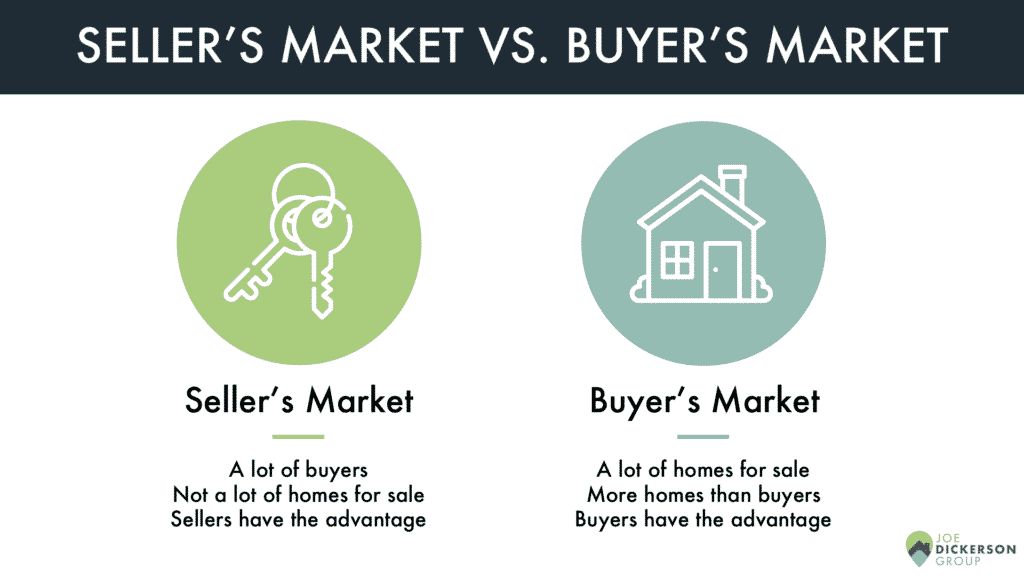

Another important part of pricing your home accurately is an assessment of market trends. The market may favor sellers or buyers, or it may be in balance. A great way to determine whether buyers or sellers currently have the upper hand is to look at a measure of the number of months of standing inventory.

When the months of standing inventory is higher, that means market trends are showing that there are more homes available for sale than there are buyers to buy them, which gives buyers an advantage. Since there are more available homes, buyers have more leverage to negotiate and have their requests met.

On the other hand, when there are fewer months of standing inventory, that means market trends are showing that there are fewer available homes, which gives sellers an advantage. There aren’t enough available homes for sale to meet the needs to all the buyers looking for homes. And since buyers won’t have as many homes to choose from, sellers have more leverage in potential negotiations.

Calculating The Months Of Standing Inventory

You can use this formula to estimate months of inventory:

1) Count the number of sales in your area and price range for the past 12 months. (Example: 60 sales between $300,000 – 500,000)

2) Divide the number of sales by 12, to get the number of sales per month. (Example: 5 sales per month)

3) Count the number of homes on the market now. (Example: 100 homes between $300,000 – 500,000)

4) Divide the number of available homes by the number of sales per month (Example: 100 homes selling at a rate of 5 per month = 20 months of supply).

The current inventory divided by the rate of sale shows the number of months it will take to clear the current inventory, which tells you whether we’re currently in a buyer’s or seller’s market.

Seller’s Market

Less than 6 months of unsold inventory is considered a seller’s market. In other words, there is a large number of buyers in proportion to the number of homes for sale. The demand for homes is greater than the supply.

In a seller’s market, buyers must compete with each other for homes. Sellers often receive multiple offers. Buyers will submit the highest price that the market will support. This leads to prices trending upward.

As of the writing of this article, it’s a seller’s market for most of the Bay Area.

Buyer’s Market

More than 8 months of inventory is considered a buyer’s market. In other words, the number of homes for sale is large when compared with the number of buyers.

A buyer’s market is typically created by excessive construction, employment decline, or high interest rates. A low number of buyers relative to the inventory results in lower prices.

In a buyer’s market, sellers must compete with each other for available buyers. This leads to prices trending downward.

Price Per Square Foot

Dollars per square foot is often used as another tool for comparing homes. Keep in mind that you must make a sliding scale adjustment from larger to smaller homes.

In other words, the larger the house, the lower the price per square foot for comparable properties. This is because the core square footage of a home has a higher value than the peripheral area. The price per square foot on a 1,000 square-foot home will be much higher than a 5,000 square-foot home, for similar quality homes.

How Should You Price Your Home?

There are a lot of nuances that go into pricing a home effectively for a quick sale here in the Bay Area. Depending on your goals, it might be wise to price your home lower than comparable sales, in order to attract more potential buyers.

In other cases, it might make more sense to price your home transparently, to more accurately reflect the current market value of your home.

Regardless, listing your home at the right price is one of the most important factors in helping you reach your goals and sell your home quickly and for top dollar.

Your best leverage occurs during the early marketing period. Your days on the market is evident to buyers and is a subtle but important factor in their decision, which is why you want to get the pricing right the first time, to leverage that initial momentum and attract the right buyers, before your home becomes a stale listing.

Related: How To Prepare Your Home For Sale In Oakland And The East Bay

How Will You Know If Your Price Is Correct?

Second looks from buyers can be the best affirmation of correct pricing. This indicates that your home appeals to buyers in your price range. There may be a few nibbles before a buyer comes forward who is ready to act. It helps to get feedback from showings.

However, keep in mind that buyers and agents are often reluctant to say something negative. Look at the overall result of all showings for confirmation of the price. If you are getting lukewarm responses, work with your real estate agent to strategize on how to boost buyer interest.

How Long Should You Market A Home At A Given Price?

There is no standard timeframe for marketing at a given price. About 8-10 showings is a reasonable number to get a sense of the market response. This usually corresponds to about 2 – 6 weeks for an average home in a balanced market.

In the Bay Area’s hot real estate landscape, this can vary wildly depending on the submarket, condition of your home, and many other factors.

As a general rule of thumb, 30 days’ marketing time is a reasonable timeframe to start with. However, this may be too short for an unusual or very high-end home, for which there may be less demand. Or, 30 days may be too long for your home if you need to move fast and there is plenty of activity.

Again, this can vary drastically in the Bay Area, so be sure to discuss timing and timeframe with your real estate agent before listing your home for sale.

What If Your Home Does Not Sell In A Reasonable Time?

When your home is on the market, you should be checking in and strategizing with your real estate agent regularly. We provide our sellers with weekly updates on showings, feedback, potential offers, and more.

This transparency and ongoing communication ensure that your home won’t sit idle and that you’re being proactive in adjusting your strategy as needed.

When we work with sellers, we have general benchmarks and expectations to guide the process. So if the number of showings falls below that range, for example, we can strategize and course-correct as needed to get the process back on track.

Are You Looking To Buy, Sell, Or Invest?

As you have seen, there’s a LOT that goes into the pricing strategy when listing a home for sale in this competitive Bay Area real estate landscape.

You only get one chance to make the right first impression, so you want to make sure you do everything in your power to get an accurate estimate of your home value, including finding the right real estate team to help you reach your goals.

That way, you can list your home at the right price and with the right strategy and thus attract the right buyers and reach your goals for the sale of your home.

If you’re considering buying, selling, or investing in a home here in Oakland, Berkeley, the East Bay, or elsewhere, we’re here to help!

We know how tricky it can be to navigate the competitive Bay Area real estate landscape, and our team is here to help you figure out the best fit for your situation and goals.

We know the Bay Area real estate landscape like the back of our hand, and we’re happy to provide you a complimentary estimate of the market value of your home – no strings attached!

To learn more and to see if we’re the right team to help you with your real estate goals, click here.